A number of initiatives have been introduced to help first time buyers purchase a home. By far the most popular is Help to Buy.

As many as seven out of 10 under 40s who are looking to buy a property this year are expected to use the Help to Buy scheme.

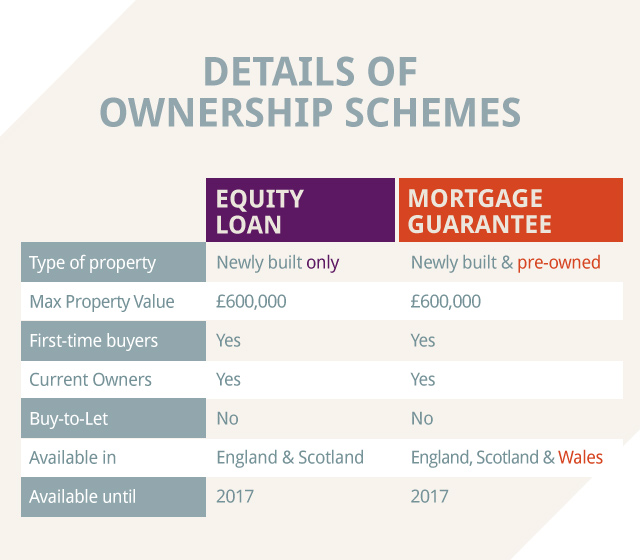

There are two parts to the scheme - the equity loan and the mortgage guarantee.

Under the equity loan scheme, the buyer must find a deposit of at least five per cent, while the government offers a loan of up to 20 per cent, interest free for five years. The remaining 75 per cent is covered by a standard mortgage.

It is only available on newly built properties up to the value of £600,000 in England, £400,000 in Scotland and £300,000 in Wales.

The deposit you need will depend on the total value of the property you buy. For example, a buyer looking to purchase a £200,000 property under the equity loan scheme will need a minimum deposit of £10,000 and a mortgage of £150,000. An equity loan of £40,000 is provided by government.

Under the mortgage guarantee scheme, lenders buy a guarantee on loans for borrowers with only a five per cent deposit. The scheme is available on newly built properties – depending on your lender – and existing homes, up to the value of £600,000

The property must be your own home and cannot be a buy-to-let investment.

A buyer looking to purchase a £200,000 property under the mortgage guarantee scheme will need a minimum deposit of £10,000 and a mortgage of £190,000.

While every effort has been taken to ensure the

above information is up to date, some inaccuracies may occur. All

information was correct at time of publication and is provided in good

faith.

No comments:

Post a Comment